La Fed finalmente tramite forward guidance si dice pronta ad inflazionare il dollaro, per sorreggere l’economia e “bruciare” i debiti.

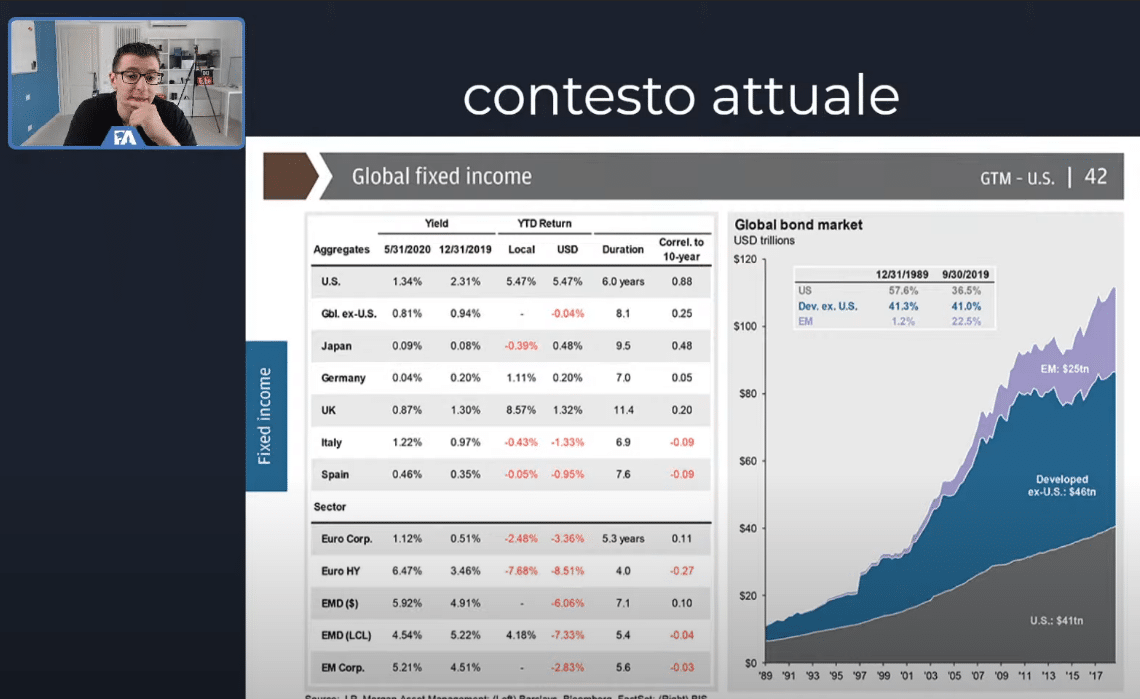

Ne parlavo in questo video (live in realtà, slide del minuto 22:13)

Ne parlavo anche prima in questo video provocatorio, ma neanche troppo…

Ed indirettamente anche qui (nel 2018)

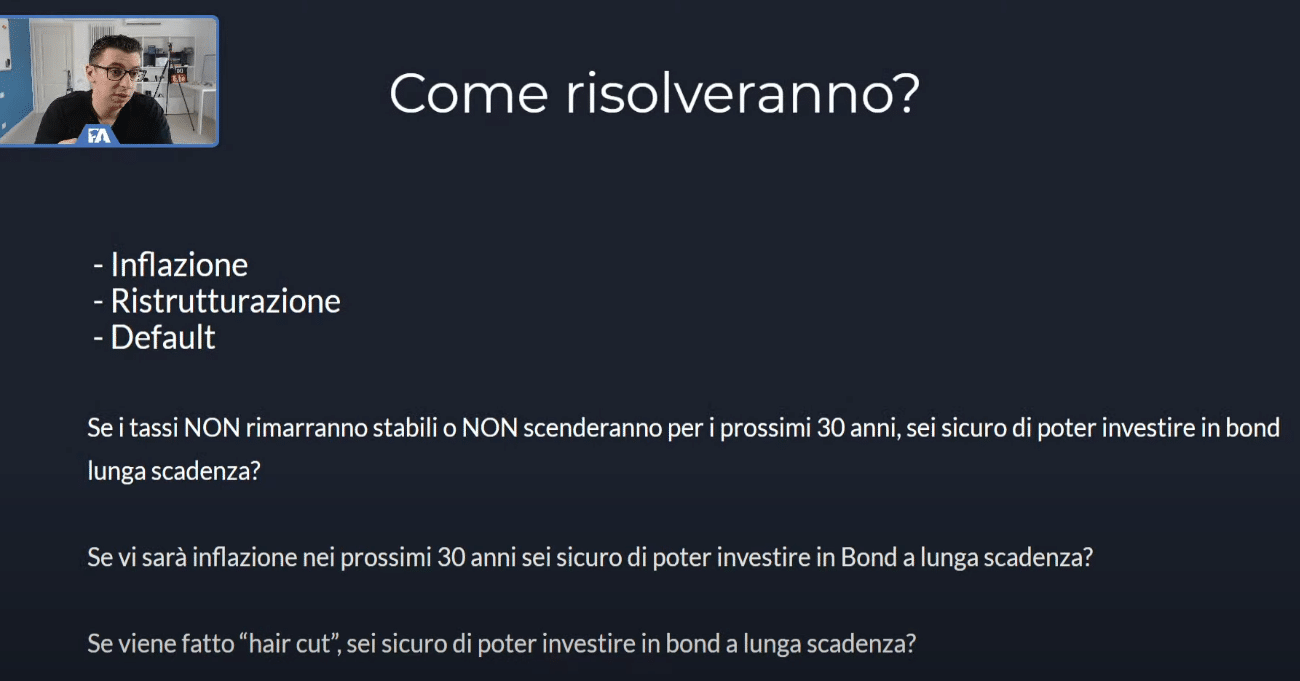

L’inflazione (se gestita bene) probabilmente è il metodo meno doloroso in assoluto (anche se sarà doloroso per alcuni) per correggere il casino che hanno fatto governi e banche centrali in primis, con stampe folli, spese improduttive e debiti giganteschi. (guardati la live è lunga ma spiego tutto per bene)

N.B. non credo, (e non mi auguro) che arriverà l’iperinflazione, ma un inflazione più sostenuta che danneggerà molti…

A farne i conti saranno più che altro i poveri, e chi non è in grado di coprirsi dall’inflazione. Anche i portafogli Lazy ormai vanno rivisti con questi cambiamenti macroeconomici. (lo stesso Ray Dalio ha aggiornato il suo all season)

Non è più uno scherzetto oramai investire e proteggere il proprio patrimonio.

Sono ormai più di tre anni che vi rompo i “cabasisi” con Bitcoin… Bitcoin è passato nel frattempo da 1000$ a 12000$ con punte di 20.000$ e molta volatilità. Ora è a 11.000-12.000$ ce poco da dire…

Se serve una mano….

oppure

Per chi se lo fosse perso, ecco tutto il discorso di Powell (Fed Chairman)

dai commenti sotto a questo video

cerco di riassumerlo qui… (occhio d’ora in poi a detenere asset che performano male quando vi è inflazione.)

Prima di tutto un ripasso alla relazione tra tassi di interesse e inflazione

Qual è la relazione tra questi due parametri?

“L’inflazione indica che il costo della vita è in aumento e quindi che l’economia è in una fase espansiva. Se la crescita è troppo rapida – i prezzi salgono più velocemente dei salari – il governo potrebbe decidere di alzare i tassi di interesse. Tale mossa pesa sui finanziamenti e favorisce il risparmio, così da rallentare l’espansione e abbassare l’inflazione.

Allo stesso modo, per dare slancio all’economia si possono abbassare i tassi di interesse. In genere, tassi di interesse inferiori consentono di contrarre maggiori prestiti e quindi avere più denaro da spendere, con la conseguente espansione dell’economia e l’aumento dell’inflazione. In breve, l’inflazione è uno degli indicatori utilizzati per misurare la crescita economica, che può essere controllata tramite i tassi di interesse, i quali a loro volta influiscono sull’inflazione.”

- La fed cercherà di massimizzare la crescita dell’occupazione

- i tassi di interesse non verranno alzati per frenare l’inflazione

- la Fed tollererà moderati aumenti di prezzi dei beni (inflazione) sopra al 2 %

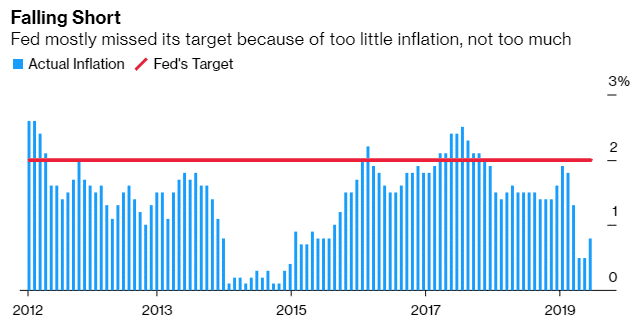

L’inflazione in questi anni è sempre rimasta sotto al 2% (target della fed) quindi per riportarla alla media tollereranno aumenti dell’inflazione sopra il 2%.

Per chi volesse la versione completa trascritta del discorso…

Jerome Powell: (00:00)

Good afternoon everyone, and welcome. My colleagues at the Federal Reserve and I are dedicated to serving the American people. We do this by steadfastly pursuing the goals Congress has given us, maximum employment and stable prices. We are committed to making the best decisions we can based on facts and objective analysis. Today we decided to lower interest rates. As I will explain shortly, we took this step to help keep the US economy strong in the face of some notable developments, and to provide insurance against ongoing risks.

Jerome Powell: (01:11)

The US economy has continued to perform well. We are into the 11th year of this economic expansion, and the baseline outlook remains favorable. The economy grew at a 2.5% pace in the first half of the year. Household spending, supported by a strong job market, rising incomes, and solid consumer confidence, has been the key driver of growth. In contrast, business investment and exports have weakened amid falling manufacturing output. The main reasons appear to be slower growth abroad and trade policy developments, two sources of uncertainty that we’ve been monitoring all year.

Jerome Powell: (01:50)

Since the middle of last year, the global growth outlook has weakened, notably in Europe and China. Additionally, a number of geopolitical risks, including Brexit, remain unresolved. Trade policy tensions have waxed and waned, and elevated uncertainty is weighing on us investment and exports. Our business contacts around the country have been telling us that uncertainty about trade policy has discouraged them from investing in their businesses. Business fixed investment posted a modest decline in the second quarter, and recent indicators point to continued softness. Even so, with households spending remaining on a solid footing, and with supportive financial conditions, we expect the economy to continue to expand at a moderate rate. As seen from FOMC participants’ most recent projections, the median expectation for real GDP growth remains near 2% this year and next, before edging down toward its estimated longer run value.

Jerome Powell: (02:48)

The job market remains strong. The unemployment rate has been near half-century lows for a year and a half, and job gains have remained solid in recent months. The pace of job gains has eased this year, but we had expected some slowing after last year’s strong pace. Participation in the labor force by people in their prime working years has been increasing, and wages have been rising, particularly for lower paying jobs. People who live and work in low and middle income communities tell us that many who have struggled to find work are now getting opportunities to add new and better chapters to their lives. This underscores for us the importance of sustaining the expansion so that the strong job market reaches more of those left behind. We expect the job market to remain strong. The median of participants’ projections for the unemployment rate remains below 4% over the next several years.

Jerome Powell: (03:46)

Inflation continues to run below our symmetric 2% objective. Over the 12 months through July, total PCE inflation was 1.4%, and core inflation, which excludes volatile food and energy prices, was 1.6%. we still expect inflation to rise to 2%. The median projection is 1.9% this year and 2% in 2021. However, inflation pressures clearly remain muted and indicators of longer term inflation expectations are at the lower end of their historical ranges. We’re mindful that continued below-target inflation could lead to an unwelcome downward slide in longer term inflation expectations.

Jerome Powell: (04:29)

Overall, as we say in our post-meeting statement, we continue to see sustained expansion of economic activity, strong labor market conditions, and inflation near our symmetric 2% objective as most likely. While this has been our outlook for quite some time, our views about the path of interest rates that will best achieve these outcomes have changed significantly over the past year. As I mentioned, weakness in global growth and trade policy uncertainty have weighed on the economy and pose ongoing risks. These factors, in conjunction with muted inflation pressures, have led us to shift our views about appropriate monetary policy over time toward a lower path for the federal funds rate. And this shift has supported the outlook.

Jerome Powell: (05:13)

Of course, this is the role of monetary policy, to adjust interest rates to maintain a strong labor market and keep inflation near our 2% objective. Today’s decision to lower the federal funds rate target by a quarter percent, to 1.75% to 2%, is appropriate in light of the global developments I mentioned, as well as muted inflation pressures. Since our last meeting, we’ve seen additional signs of weakness abroad and a resurgence of trade policy tensions, including the imposition of additional tariffs. The Fed has no role in the formulation of trade policy, but we do take into account anything that could materially affect the economy relative to our employment and inflation goals.

Jerome Powell: (05:55)

The future course of monetary policy will depend on how the economy evolves, and what developments imply for the economic outlook and risks to the outlook. We’ve often said that policy is not on a pre-set course, and that is certainly the case today. As I’ve noted, the baseline economic outlook remains positive. The projections of appropriate policy show that participants generally anticipate only modest changes in the federal funds rate over the next couple of years. Of course, those views are merely forecasts, and as always, will evolve with the arrival of new information. Let me say a few words about our monetary policy operations. Funding pressures in money markets were elevated this week, and the effective federal funds rate rose above the top of its target range yesterday. While these issues are important for market functioning and market participants, they have no implications for the economy or the stance of monetary policy.

Jerome Powell: (06:54)

This upward pressure emerged as funds flowed from the private sector to the Treasury, to meet corporate tax payments and settle purchases of Treasury securities. To counter these pressures, we conducted overnight repurchase operations yesterday and again today. These temporary operations were effective in relieving funding pressures and we expect the federal funds rate to move back into the target range.

Jerome Powell: (07:17)

In addition, as we’ve done in the past, we made a technical adjustment to the interest rate paid on required and excess reserve balances, setting it 20 basis points below the top of the target range for the federal funds rate. In a related action, we also adjusted the rate on the overnight repurchase facility to five basis points below the bottom of the target range. We will continue to monitor market developments and will conduct operations, as necessary, to foster trading in the federal funds market at rates within the target range. Consistent with our decision earlier this year to continue to implement monetary policy and an ample reserves regime, we will, over time, provide a sufficient supply of reserves so that frequent operations are not required. To summarize, we are fully committed to pursuing our goals of maximum employment and stable prices. As the committee contemplates the future path of the target range for the federal funds rate, it will continue to monitor the implications of incoming information for the economic outlook, and will act as appropriate to sustain the expansion with a strong labor market and inflation near its symmetric 2% objective.

Jerome Powell: (08:24)

Thanks. I’ll be happy to take your questions.

Speaker 1: (08:26)

Marty.

Marty C.: (08:29)

Marty Crutsinger with the Associated Press. Mr. Chairman, when you cut rates in July, you characterized it as a mid-cycle adjustment. Is that still your view of what’s happening?

Jerome Powell: (08:42)

So as you can see from our policy statement and from the SEP, we see a favorable economic outlook, with continued moderate growth, a strong labor market, and inflation near our 2% objective. And by the way, that view is consistent with those of many other forecasters. As you can see, FOMC participants generally think that these positive economic outcomes will be achieved with modest adjustments to the federal funds rate. At the last press conference, I pointed to two episodes in I guess 1995 and 1998, as examples of such an approach which was successful in both of those instances.

Jerome Powell: (09:23)

As our statement also highlights though, there are risks to this positive outlook, due particularly to weak global growth and trade developments. And if the economy does turn down, then a more extensive sequence of rate cuts could be appropriate. We don’t see that, it’s not what we expect, but we would certainly follow that path if it became appropriate. In other words, as we say in our statement, we will continue to monitor these developments closely and we will act as appropriate to help ensure that the expansion remains on track.

Speaker 1: (09:53)

Rich.

Rich Miller: (09:53)

[inaudible 00:09:53] I’m sorry. Rich Miller with Bloomberg. Taking the statement, your opening remarks, and the SEP, I’m just wondering what kind of message we should take from this. Is it safe to say this FOMC still has an easing bias, or not?

Jerome Powell: (10:16)

So the idea of having a bias is something that was a longtime practice, and we don’t actually have that practice anymore, so I can’t really adopt it right here. But nonetheless, I’ll respond to your question. So we made one decision today, and that decision was to lower the federal funds rate by a quarter percentage point. We believe that action is appropriate to promote our objectives, of course. We’re going to be highly data-dependent. As always, our decisions are going to depend on the implications of incoming information for the outlook.

Jerome Powell: (10:46)

And I would also say, as we often do, that we’re not on a pre-set course. So that’s how we’re going to look at it. We’re going to be carefully looking at economic data. Sometimes the path ahead is clear, and sometimes less so. So we’re going to be looking carefully, meeting by meeting, at the full range of information, and we’re going to assess the appropriate stance of policy as we go. And as I said, we we will act as appropriate to sustain expansion.

Rich Miller: (11:15)

If I could just follow up, you’ve also said that the favorable outlook is predicated on financial conditions. And the financial conditions are, in turn, predicated on an outlook for Fed policy, and in this case, a further cut. Wouldn’t that suggest that you should be inclined to, if you want those financial conditions and that favorable outlook to come about, you should be inclined to cut?

Jerome Powell: (11:40)

Well, what we do going forward is very much going to depend, Rich, on the flow of data and information. We’ve seen, if you look at the things we’re monitoring, particularly global growth and trade developments, global growth has continued to weaken. I think it’s weakened since our last meeting. Trade developments have been up and down, and then up, I guess, or back up, perhaps, over the course of this inter-meeting period. In any case, they’ve been quite volatile. So we do see those risks as actually more heightened now. We’re going to be watching that carefully. We’re also going to be watching the US data quite carefully, and we’ll have to make an assessment as we go.

Speaker 1: (12:27)

Okay, Nick.

Nick Timiraos: (12:27)

Thank you, Mr. Chairman. Nick Timiraos, The Wall Street Journal. I know you’re trying to speak for the committee when you do these press conferences, but the committee is clearly divided right now, at least about the outlook and the appropriate policy path. Some people think you need to wait and see the labor market and the consumer crack or weaken further, before acting more aggressively. And some people think that, by the time that happens, you’ll need to do even more aggressive action to arrest a downturn. Where do you stand on this?

Jerome Powell: (12:59)

Hm. Well, let me just say, on the general point of diverse perspectives, you’re right, sometimes, and there’ve been many of those times in my now almost eight years at the Fed, many times when the direction is relatively clear and it’s relatively easy to reach anonymity. This is a time of difficult judgments, and as you can see, disparate perspectives. And I really do think that’s nothing but healthy. And so, I see a benefit in having those diverse perspectives, really.

Jerome Powell: (13:31)

So your question though is-

Nick Timiraos: (13:33)

Is to your own view, because the data is, to some extent, lagged, especially when you have these risks on the horizon. And the markets obviously think these risks could materialize more than what you and your colleagues are projecting in the dot plot today. So I wonder, where are your own views about the tension between risk management, which implies some degree of data independence, and this idea of being data-dependent?

Jerome Powell: (13:58)

Yeah. So I’ll try to get at that this way. I think that the idea that if you see trouble approaching on the horizon, you steer away from it, if you can, I think that’s a good idea in principle. And I think history teaches us that it’s better to be proactive in adjusting policy, if you can. I think applying that principle in a particular situation is where the challenge comes.

Jerome Powell: (14:23)

So I told you where the committee, the bulk of the committee, is going meeting by meeting. And I think the main takeaway is that this is a committee that has shifted its policy stance repeatedly, consistently through the course of the year, to support economic activity as it has felt that it’s appropriate. At the beginning of the year, we were looking at further rate increases. Then we were patient. And then we cut once. Then we cut again. And I think you’ve seen us being willing to move based on data, based on the evolving risk picture. And I have no reason to think that will change. I think … But it will continue to be data-dependent, and data includes the evolving risk picture. That’s where I am, and that’s where, I think, the bulk of the committee is.

Speaker 1: (15:08)

Steve.

Steve Liesman: (15:09)

Mr. Chairman, I wonder if you’re … Oh, sorry, Steve Liesman, CNBC. I’ve only done this a dozen amount of times. I wonder if you’re concerned about how the Federal Reserve operated through the recent liquidity crunch in markets. We talked to many traders who said the tax state payment was known well in advance. There were several reports of people pointing to September as a potential crunch time. You closed Monday at the top end of the fed funds rate. Tuesday came along, and there wasn’t an operation until 9:00, and no announcement until, of a second operation, until 4:00 in the afternoon. Was the Fed listening to markets well ahead of time, going back a year when there were blowouts in the overnight rate at year end, and the turn of the year? Are you concerned about how, for example, the New York Fed operated through this?

Jerome Powell: (16:05)

So I would say I doubt that anyone is closer to and has more invested in, in carefully following the behavior of these markets. So of course, we were well aware of the tax payments and also of the settlement of the large bond purchases. And we were very much waiting for that. But we didn’t expect … The response to that was stronger than we expected. And by the way, our sense is that it surprised market participants a lot too. I mean, people were writing about this and publishing stories about it weeks ago. It wasn’t a surprise, but it was a stronger response than, certainly than we expected. So, no, I’m not concerned about that, to answer your question.

Jerome Powell: (16:49)

I can go on a little bit about how we’re looking at that. Why don’t I do that? So as I mentioned, we don’t see this as having any implications for the broader economy or for the economic outlook, nor for our ability to control rates. The strains in the money markets reflect forces that we saw coming, and they just had a bigger effect than I think most folks anticipated, strong demand for cash to purchase treasuries and pay corporate taxes. We took appropriate actions to address those pressures, to keep the fed funds rate within the target range, and those measures were successful. If we experience another episode of pressures in money markets, we have the tools to address those pressures. We will not hesitate to use them.

Jerome Powell: (17:29)

And since we’re talking about this, let me take a step back and say this. Earlier in the year, as you will all recall, after careful study over a period of years actually, the committee announced the decision to implement monetary policy and an ample reserves regime. And we’ve been operating in that regime for a full decade. We think it works well to implement our rate decisions. The main hallmark of that regime is that we use adjustments in our administered rates, the IOER and RRP rates, to keep the fed fund rates rates in the target range. It’s designed specifically so that we do not expect to be conducting frequent open market-

Jerome Powell: (18:03)

… specifically so that we do not expect to be conducting frequent open-market operations for that purpose. So, going forward, we’re going to be very closely monitoring market developments and assessing their implications for the appropriate level of reserves and we’re going to be assessing the question of when it will be appropriate to resume the organic growth of our balance sheet. And I’m sure we’ll be revisiting that question during this inter-meeting period and certainly at our next meeting.

Reporter 1: (18:28)

[inaudible 00:18:28] … really quickly, do you think you’ve underestimated the amount of reserves necessary for the banking system?

Jerome Powell: (18:33)

So, we’ve always said that the level is uncertain. And that’s something we’ve tried to be very clear about. And as you know, we’ve invested lots of time talking to many of the large holders of reserve to assess what they say is their demand for reserves. We try to assess what that is. We’ve tried to combine that all together, we’ve put it out so the public can react to it. But yes, there’s real uncertainty and it’s certainly possible that we will need to resume the organic growth of the balance sheet earlier than we thought. That’s always been a possibility and it certainly is now. Again, we’ll be looking at this carefully in coming days and taking it up at the next meeting.

Brendan Greeley: (19:17)

Brendan Greeley with the Financial Times. Earlier this year or actually in September, the Governor’s Board put out a research paper looking, trying to quantify trade uncertainty. And it suggested that it could drag through the business investment channel on growth as much of a percentage point over the course of the next year. How much confidence do you have in the FED’s ability to estimate the real effects of trade uncertainty? And if you have confidence in that paper, it would seem to suggest a more aggressively dovish path than the one that you’ve chosen.

Jerome Powell: (19:50)

Yeah, so I think to provide a little context, FED economists do research all the time. It’s generally of very high quality. It’s their research, it’s not an official finding of the FEDeral Reserve Board or the FEDeral Reserve System. And by the way, they put it out for public review that you can see their econometrics, you can see all of it, their whole work is exposed to critique by the whole profession. So, it’s a great tradition that we have.

Jerome Powell: (20:18)

And what this particular piece of work did is it went after measuring trade policy uncertainty through a couple of channels including concerning tariffs, also concerning the threat of more tariffs and it looked deeply at the data to try to assess the effects on output. And while I would say directly answering your question, there’s real uncertainty around these effects. It’s a $22 trillion economy to try to isolate the effects of certain things is very challenging. But we do the best we can.

Jerome Powell: (20:49)

And so, this piece of research found significant effects and that’s frankly consistent with a number of other research projects that economists have undertaken. It’s also consistent with what we’ve been hearing in the Beige Book. So, I think if you take a step back from that, we do feel that trade uncertainty is having an effect. You see it in weak business investment, weak exports, hard to quantify it precisely, though.

Howard S: (21:21)

Hi, Howard Schneider with Reuters. I was struck by the anchored median FEDeral funds rate here through 2020. And that in comparison to the fact that you now have three very discreet groups of opinions around where the FED funds rate is heading and I wonder, is it fair to say that those opinions have become firmer in their conviction in that it’s going to take some sort of real, material change in the outlook now for that to move in either direction?

Jerome Powell: (21:53)

And you’re asking specifically about 2020?

Howard S: (21:56)

Well, the fact that the FED’s funds rate is now seen as not moving through 2020, suggesting to me that these opinions are pretty well anchored right now in those groups.

Jerome Powell: (22:05)

You know, honestly, I think it’s hard to have hardened expectations about where rate policy’s going to be a year from now. I think the closer you get to the current day, the more confidence you can have, but even then, knowing what the data will say and the way geopolitical events and other events are going to evolve in the next 90 days and the implications of that for the economy, I would say there’s a lot of uncertainty around that.

Howard S: (22:34)

Fair enough.

Jerome Powell: (22:34)

Particularly, if you look at 2020, I think the use of this is individual participants write down their forecasts. It should give you a sense of how people are thinking about the likely path of the economy and the appropriate path for monetary policy in that individual person’s thinking. And I think that’s a good thing to know. I think I’d be very reluctant to look at it as hardened views or a prediction, really.

Howard S: (22:59)

Just to follow up if I could, there were a number of arguments in July around the reason for cutting rates. Have any of those gotten substantially weaker or changed around the table?

Jerome Powell: (23:09)

No. I think if you look at the U.S. economy, the U.S. economy has generally performed roughly as expected, roughly. Consumers spending at a healthy clip, I’d say business fixed investments and exports have weakened further and I’d say the manufacturing PMI suggests more weakness ahead. The labor market’s still strong, though, so generally that is the same. I think if you look at the global economy, I think has weakened further in the E.U. and China and I think trade policy developments have been a big mover of markets and of sentiment during that inter-meeting period.

Jerome Powell: (23:48)

So that’s why I think that’s what’s happened over the inter-meeting period and different people around the table have different perspectives as you obviously know.

Gina Smialek: (23:58)

Hi Chair Powell, Gina Smialek with the New York Times. I’m just curious on your balance sheet point. You talked about the committee thinking about resuming organic growth over time. I guess the question is if you have shrunk your balance sheet maybe just a little bit too small to the point that reserves are too scarce to get through these unusual periods. Is organic growth in the balance sheet enough to get back to a point of ample reserves that can get us through those tough times or would you need to see something a little bit above that and is that a possibility the committee would consider?

Jerome Powell: (24:40)

I think it’s hard to deal with every hypothetical possibility. I think for the foreseeable future, we’re going to be looking at if needed, doing the sorts of things that we did the last two days, these temporary open-market operations. That’ll be the tool that we use. And the question will be then, as we go through quarter end, as we learn more, how much of this really has to do with the level of reserves and I think we’ll learn quite a lot in the next six weeks.

Victoria Guida: (25:18)

Victoria Guida with Politico. Another money-market question. Banks have been pointing to liquidity rules as having contributed to some of the volatility we’ve seen in repo markets and potentially some capital rules as well. Are you all looking at whether some tweaks to the liquidity coverage ratio might help and also, what is the status of the net stable funding ratio rule? Are you all still planning on putting that out soon?

Jerome Powell: (25:47)

I think if we concluded that we needed to raise the level of required reserves for banks to meet the LCR, we’d probably raise the level of reserves rather than lower the LCR. It’s not impossible that we would come to a view that the LCR’s calibrated too high, but that’s not something that we think right now. On the other hand, it might be that more reserves are needed in which case we are in a position to supply them.

Jerome Powell: (26:12)

In terms of the net stable funding ratio, I believe we put it out for comment and got comments and I believe we’re looking at finalizing that in the relatively near future.

Victoria Guida: (26:28)

Just a follow up, in terms of tweaks to the LCR, there’s also been some talk about potentially giving banks some room in times of stress to maybe dip into their liquidity buffers.

Jerome Powell: (26:40)

I think we want banks to use their liquidity buffers in times of stress rather than pull back from the markets and pull back from serving their clients as a general rule.

Edward Lawrence: (26:57)

So, about a month ago … Edward Lawrence from FOX Business Network. Thank you, Mr. Chairman. About a month ago or so, you said that there’s no precedent to integrate trade uncertainty into monetary policy. In the last few weeks, have you figured out how to incorporate trade uncertainty and this level of trade uncertainty into monetary policy going forward? And you’ve talked about uncertainty many times today.

Jerome Powell: (27:16)

My point really was, to start, that trade policy’s not the business of FED, it’s the business of Congress and the Administration. So, why are we talking about it? We’re talking about it, because anything that affects the achievement of our goals can, in principle, be something that monetary policy should take into consideration. And our discussions and the research we have suggests that trade policy is something that’s weighing on the outlook. So, I pointed out in recent remarks that the thing we can’t address, really, is what businesses would like, which is a settled roadmap for international trade.

Jerome Powell: (27:56)

We can’t do that. We don’t have that tool. But we do have a very powerful tool, which can counteract weakness to some extent by supporting demand through sound monetary policy. And we think our policy tools support economic activity through fairly well-understood channels by reducing interest burden and encouraging consumer purchase of durables, of homes, and other intra-sensitive items by creating broadly more accommodating financial conditions, which supports spending and also investment by businesses. And also by boosting household and business confidence.

Jerome Powell: (28:29)

So, I don’t want to be heard to say that our tools don’t have an effect. They do. But I was making the point that there’s a piece of this that we really can’t address.

Edward Lawrence: (28:41)

So, have you figured out how to enact it?

Jerome Powell: (28:41)

Well, I think yeah, it’s a challenge. There’s no simple, bottom-line answer where I can say yes, I’ve got it for you here. But what it amounts to is this: what you see is probably the kind of volatility that’s typical of an important, complex, ongoing negotiation. And I think what we need to do is to try to look through the volatility and react to the underlying forces, the underlying things that are happening that are relevant to our mandate.

Jerome Powell: (29:13)

We have nothing to do with setting trade policy or negotiating trade agreements. We’re supposed to be reacting o behalf of the American economy to support maximum … [inaudible 00:29:23] … and stable prices. So, we need to look through what’s a pretty volatile situation. So, that means not overreacting quickly, it means not under reacting too, so that’s really what we’re trying to do. And I would say the outlook is positive in the face of these crosswinds we’ve felt and so, to some extent, I do believe that our shifting to a more accommodating stance over the course of the year has been one of the reasons why the outlook has remained favorable.

Michael McKee: (29:59)

Fed funds … Michael McKee from Bloomberg Radio and Television. Fed funds futures trading since the statement was released shows that investors still think that another rate cut is coming this year. On their behalf, let me ask, what is going to guide FED policy to either pull them towards where the dot plot suggests no more moves this year or keep them in place. Are you reacting to data now? Are you reacting to your gut feeling about what trade tweets might mean. Should they just watch for Jay Powell’s speeches to decide what’s going to happen going forward? What’s the FED’s reaction function now?

Jerome Powell: (30:41)

Right, so what we are looking for through all of the data, all of the events that are going on around the world, we’ll be looking at the evolving geopolitical events, we’ll be looking at global growth, we’ll be looking at trade policy uncertainty. Most importantly, we’ll be looking at the performance of the U. S. economy. We’ll be looking for things that are affecting the outlook for the U.S. economy, particularly the outlook as it relates to maximum employment and stable prices.

Jerome Powell: (31:10)

So, all of those things in principle can affect the achievement of our goals. It’s unusual situation, because the U.S. economy itself, the largest part of it, the consumer part of it, is in strong shape. The manufacturing part less so, but overall you see an economy that I think generally forecasts show growth similar to our own, forecasts coming in at about two percent, which is a good solid year. So, the difference here is we have significant, really, risks to that outlook from not just the geopolitical events, but also from slowing global growth and trade policy uncertainty.

Jerome Powell: (31:50)

So, we’ll be looking at all of that and also financial market conditions and how they are affecting the outlook. It’s a challenging time, I admit it, but we really have to be open to all those things. We’re not on a pre-set course. We’re going to be making decisions meeting by meeting as we see this and we’ll try to be as transparent as we can as we go.

Donna Borak: (32:19)

Hi, Chairman Powell. Donna Borak with CNN. With the rate cut today and potentially another modest adjustment coming down the road, do you worry about lessening the FED’s firepower should there be a recession? And is there any scenario in which you would envision rates drifting lower into negative territory? And are there any other tools that you could use before having to go there? Thanks.

Jerome Powell: (32:48)

In terms of firepower, I think the general principle, as I mentioned earlier, is it can be a mistake to try to hold onto your firepower until a downturn gains momentum. And so, there’s a fair amount of research that would show that’s the case. Now, I think that principle needs to be applied carefully to the situation at hand. What we believe we’re facing here, what we think we’re facing here is a situation which can be addressed and should be addressed with moderate adjustments to the federal funds rate.

Jerome Powell: (33:19)

As I mentioned, we are watching carefully to see whether that is the case. If, in fact, the economy weakens more, then we’re prepared to be aggressive and we’ll do so if it turns out to be appropriate. You mentioned negative interest rates. So, negative interest rates is something that we looked at during the financial crisis and chose not to do. After we got to the effective lower bound, we chose to do a lot of aggressive forward guidance and also large-scale asset purchases.

Jerome Powell: (33:51)

And those were the two unconventional monetary policy tools that we used extensively. We feel that they worked fairly well. We did not use negative rates and I think if we were to find ourselves at some future date again at the effective lower bound, again not something we are expecting, then I think we would look at using large-scale asset purchases and forward guidance. I do not think we’d be looking at using negative rates. I just don’t think those will be at the top of our list.

Jerome Powell: (34:22)

By the way, we are in the middle of a monetary policy review where we’re looking through all of these questions about the longer-run framework, the strategy tools and communications. And we expect that to be completed some time around the middle of next year.

Don Lee: (34:41)

Don Lee with the L.A. Times. How much … and can you talk about the mechanism, which the two rates cuts will effect the real economy and how much, to what extent will it offset the negative effects of trade uncertainty and tensions?

Jerome Powell: (35:02)

So, in terms of how our rate cuts will affect the real economy, first we think monetary policy works as Friedman said, long and variable lags, so I think the real effects will be felt over time. But we think that lower interest rates will reduce interest burden for borrowers, so that interest-sensitive things like housing and durable goods and other things like that, cars, it supports purchases of those. Again, just broadly more accommodating financial conditions, higher asset prices.

Jerome Powell: (35:38)

That’s the models and the data show that that’s another powerful channel. I also think there’s a confidence channel. You see household and business confidence turn up when financial conditions become more accommodating. So, I think through all of those channels, monetary policy, works. It isn’t precisely the right tool for every single possible negative thing that can happen to the economy, but …

Jerome Powell: (36:03)

… single possible negative thing that can happen to the economy. But nonetheless, it broadly works, and we’re going to use the tool we have. And if it comes to it, we’ll use all of our tools. So that’s how we think it works, and how we think it’s working.

Speaker 2: (36:17)

[inaudible 00:36:17] trade [inaudible 00:36:20]?

Jerome Powell: (36:19)

It’s very hard to say. It’s tough to say. We’ll use our tools to offset negative. That’s really the job of monetary policy is to the extent it can to offset things that drive us away from maximum employment and stable prices.

Nancy: (36:36)

I’m Nancy Marshall [Ginzer 00:36:42] with Marketplace. Chair Powell, are you worried that the low interest rates are adding to or could create a bubble of consumer and corporate debt that could make it more difficult for especially consumers to recover from the next recession or survive the next recession?

Jerome Powell: (37:01)

You know, if you actually look at households, households are in very strong shape. They’re less levered. They’ve got less debt. They’ve got more income relative to their interest requirements, and that they’re in very good shape, much better shape than they were in before the financial crisis. So the household sector as a sort of aggregate matter is in very good shape. That doesn’t mean that every single person in the household sector is in good shape, but overall it’s really not a concern. The business sector is something that we’ve talked about a lot and studied a lot, and the situation there is that the level of debt relative to GDP in the business sector is at a high level. However, so is the size of the business sector. So actually the business sector itself is not materially higher leverage than it was.

Jerome Powell: (37:54)

Nonetheless, there are a lot of highly levered companies, and that’s the kind of thing that happens during a long cycle when there aren’t downturns for, now into our 11th year, you do get that kind of phenomenon in a long cycle. So that’s something we’re monitoring, and I think our view still is that, that’s a real issue. But what it really represents is a potential amplifier of a macroeconomic downturn.

Jerome Powell: (38:21)

It does not have the makings of anything that would undermine the workings of the financial system, for example, or itself create a shock that would turn the economy down. It’s more of an amplifier. We take it very seriously, though, and we’re monitoring it carefully. We’re actually looking, the Federal Financial Stability Board is actually conducting a project right now to identify where these loans are held all around the world. So it’s a subject of a lot of study and work, and we’re trying to keep on top of it.

Greg: (38:59)

Thank you, Chairman Powell. Greg Rob from MarketWatch. I’m kind of hearing two things from you. You’re saying that the economy is doing well, but there’s this sense with people that the economy is actually starting to slow now, and people are more and more, there’s talk about recession, and even the Fed thinks the downside risks are arriving. So is economy over the next year, between now and the end of next year, do you think GDP growth is going to hold steady and the unemployment rate … Could you talk about just how do you see the economy evolving over the next year?

Jerome Powell: (39:35)

I think in my colleagues, and my colleagues and I, I think, all think that the most likely case is for continued moderate growth, continued strong labor market, and inflation moving back up to 2%. I think that’s, by the way, widely shared among the forecasters. The issue was more the risks to that. You have downside risks here, and we’ve talked about them. It’s that global growth will have an effect on U.S. growth over time, less so than for many other economies. But still, there’s a sector of our economy that’s exposed to that.

Jerome Powell: (40:05)

Trade policy uncertainty also apparently has an effect, and you can see some weakness in the U.S. economy because of all that. But nonetheless, so the job of monetary policy is to adjust both to insure against those downside risks, but also to support the economy in light of the existing weakness that we do see. So we’re not, as I mentioned, we don’t see a recession, we’re not forecasting a recession, but we are adjusting monetary policy in a more accommodative direction to try to support what is in fact a favorable outlook.

Greg: (40:43)

And the inverted yield curve that we hear is the bond market signaling recession, is that … So that signal is not pertinent to you, or where do you-

Jerome Powell: (40:55)

No, so we monitor the yield curve carefully along with a large, wide range of financial conditions. There’s no one thing that that is dispositive among all financial conditions. The yield curve is something that we follow carefully, and again, based on our assessment of all the data, we still think it’s a positive outlook. Just to talk about the current situation, you saw the longterm rates move down a whole lot and then retrace two-thirds of that move in the space of a few days. So I think what really matters for all financial conditions generally is when there are changes, material changes that are sustained for a period of time.

Jerome Powell: (41:44)

But why are longterm rates low? There can be a signal about expectations about growth there for sure, but there can also just be low term premiums. For example, it can just be that there’s this large quantity of negative yielding and very low yielding sovereign debt around the world, and inevitably that’s exerting downward pressure on U.S. sovereign rates without really necessarily having an independent signal. Nonetheless, that is a signal about weak global growth probably, and weak global growth would affect us. So global capital markets and the global economy are quite integrated. This is something we pay careful … We’re not going to be dismissive about the yield curve, and I think you can tell, on the committee there’s a range of views. There are some who are very focused on the yield curve, others not so much. From my perspective, you watch it carefully, and I think you need to be asking yourself a lot of questions if the yield curve is inverted as to why that is and how long it’s sustained.

Speaker 3: (42:43)

Okay. Paul?

Paul: (42:49)

Hi, Chairman Powell, Paul Kiernan from Dow Jones Newswires. You mentioned trade policy being a complex ongoing discussion. What is your rule for stopping as far as interest rate cuts go? You referred to this as a mid-cycle adjustment. The median dot suggests no more rate cuts. But if we get continued back and forth between the U.S. And China trade policy, uncertainty is going to remain heightened. Under what circumstances would you say, “You know what? I think we’ve cut enough. We stop now.” And secondly, as leader of this institution, have you felt a need to take any steps to boost employee morale at a time when the President is constantly criticizing the Fed? Thanks.

Jerome Powell: (43:48)

You know, I’d love to be able to articulate a simple straightforward stopping role, but it’s really just going to be when we think we’ve done enough, and our eyes are open, we’re watching the situation, we’ve cut rates twice. We’ve moved really through the course of this year, as I discussed, and we see ourselves as taking actions to sustain the expansion and thereby achieve our goals. And if you look at things that are happening in the economy, I think I personally see a high value in sustaining the expansion, because we really are reaching, this positive economy is reaching communities that haven’t been reached in a long time. There’d be great benefit in having that last as long as possible. That’s all.

Jerome Powell: (44:31)

So I don’t have a specific stopping rule for you, but I think we’re watching carefully and there we’ll come at time, I suspect, when we think we’ve done enough, but there may also come a time when the economy worsens and we would then have to cut more aggressively. We don’t know. We’re going to be watching things carefully, the incoming data and the evolving situation, and that’s what’s going to guide us on that path. In terms of the morale of the institution, I would say it’s very high. We’re very unified. We feel like we’re doing the best job we can and serving the American people.

Speaker 3: (45:11)

Hannah?

Hannah: (45:11)

Hi, Chairman, Hannah Lang with American Banker. It’s been reported that the CFPB is investigating Bank of America for opening unauthorized accounts. I’m wondering if the Fed is also investigating this, and given the pending order against Wells Fargo if you’re concerned that these banks are too big to manage.

Jerome Powell: (45:29)

You know, I saw the headline this morning during all of the preparation and everything in this morning’s meeting. I really don’t have anything for you on that. I will say about Wells Fargo that there were quite wide breakdowns in risk management which resulted in mistreatment of consumers that we know was quite harmful to the consumers and to the image of the institution. I have no idea whether that’s what happened at Bank of America. I really don’t know standing here today.

Speaker 3: (45:56)

Steve? Steve Beckner. Yeah.

Steve: (46:08)

Steve Beckner filing for NPR freelance. The Fed and your fellow central banks have been exploring the far reaches of what’s possible for monetary policy, even going so far as to make rates negative in some cases with mixed results. Meanwhile, fiscal and regulatory, not to mention trade policy, are pursuing their own separate courses. As you and your colleagues do this monetary policy framework review, do you ever consider the limitations of monetary policy? Should you be more explicit about about what monetary policy can and cannot do in this environment?

Jerome Powell: (46:58)

You know, we try to be clear about that, but really I think our job is to use our tools as best we can to do the jobs that Congress has assigned us, which is achieve maximum employment and stable prices. That’s our real job. In terms of giving the fiscal authorities, who by the way are the ones who created us, advice about how to do their job, we keep that at a high level, I think.

Jerome Powell: (47:27)

And at a high level, yes, I would say, and I’ve said before that it’s really fiscal policy that is more powerful, and that has much more to do with fiscal policy can do those things that will increase the longer run growth weight rate of the United States by improving productivity and labor force participation and the skills and aptitudes of workers. all of that comes from the private sector but also from more of the kinds of things that can be done with fiscal policy. Over the long run, we can’t really affect the growth rate of the United States. The potential growth rate in United States is not a function of monetary policy. It’s a function of of other things. I try to be clear about that, but ultimately fiscal authorities will do what they deem appropriate.

Speaker 3: (48:25)

Okay, [Samira 00:00:48:30], BBC.

Samira: (48:29)

Samira Hussein, BBC News. Mr. Trump has been a very vocal critic of you and your colleagues recently, calling you boneheads and just now has called you a terrible communicator. How do you respond to these criticisms and any regrets to have this many press conferences?

Jerome Powell: (48:48)

I don’t. I’m not going to change my practice here today of not responding to comments or addressing comments made by elected officials. I will just say that I continue to believe that the independence of the federal reserve from direct political control has served the public well over time, and I assure you that my colleagues and I will continue to conduct monetary policy without regard to political considerations. We’re going to use our best judgment based on facts, evidence, and objective analysis in pursuing our goals, and that’s what I have to say on that.

Speaker 3: (49:26)

Brian?

Brian: (49:32)

Hi, Chairman Powell, Brian Shawn with Yahoo Finance. Thanks for taking my question. As we saw with falling yields, at least up until the beginning of this month, there’s been a lot of demand for U.S. treasuries and even that was partly maybe to blame for the liquidity crunch and repo markets that we saw this week. Does the Fed have concerns over the impacts of a global glut for U.S. debt? Is that a conversation that you also have with Treasury Secretary Mnuchin about what the proper way to maybe address some of the challenges down the road with that type of heavy interests globally?

Jerome Powell: (50:02)

Not really, no. That’s really Treasury’s job and Congress’s job, in terms of whether it’s how much to spend and how big the deficits are, and there’s how to finance it, and none of that really calls for advice from the Fed. We take fiscal policy pretty much as exogenous to our work. Now, that doesn’t stop us from time to time from saying that we think it’s important that the U.S. Fiscal picture return to a sustainable footing, and right now it’s not. That’s been the case for a long time, and that’s something we will have to address, and a good time to do it is when the economy is strong. So we limit ourselves to high level statements like that.

Speaker 3: (50:44)

Okay, Heather, for the last question.

Heather: (50:47)

Hi, Heather long from the Washington Post. Mr. Chairman, in your view, is there any risk to the United States having much higher interest rates than Europe, and Japan, and other parts of the world? Is there any risk to the U.S. Economy to that divergence or any risks to the global economy?

Jerome Powell: (51:06)

Yeah, so I guess I would say it this way. Global capital markets are highly integrated, and our long rates are definitely being pulled down by the very, very low rates that are abroad. The way I would characterize it is this, that low rates abroad are a sign of weak global growth, expectations of low inflation, low growth, and a lack of policy space to move against, or ideas about how to break out of that low equilibrium. Now, that has implications for us. In a world where we’re economies and financial markets are tightly integrated, that matters for the U.S. economy. So that’s going to pull down U.S. rates, and U.S. financial conditions can tighten because of that, and so I think all of that goes into our thinking and into our models. We do understand how the international sector interfaces with the U.S. Economy. We take that into account in setting our interest rate policy.

Speaker 3: (52:18)

Okay. Thank you.

Jerome Powell: (52:18)

Thank you very much.